VISA and Mastercard: new pricing model from January 2021.

News, 05.08.2020

As of 1 January 2021 there will be a change in the pricing of the card brands VISA and Mastercard which is explained in more detailed below.

Scope of application.

The change affects all public transport companies (LTCs) connected to SBB Payment that receive payment services. There will be changes to the commission charged with payments by VISA and Mastercard credit and debit cards.

| Brand | Previous pricing model | New pricing model |

|---|---|---|

| Visa credit card | Fixed commission | ICF++ |

| Visa debit card (V-Pay, Visa Debit) | Fixed commission | ICF++ |

| Mastercard credit card | Fixed commission | ICF++ |

| Mastercard debit card (Debit Mastercard) | Fixed commission | ICF++ |

| Maestro | Fixed price | Fixed price |

There has been a lot of movement in the credit card market in recent years. On the one hand, the card issuer fee (interchange fee) has risen sharply after a quiet period in international payments. On the other hand, the card scheme fee has been subject to regular changes which have related to price increases for some time.

SBB has been able to reduce or at least maintain its prices in recent years. New rules issued by the card associations play an important role in this process. As of 1 January 2021, there will be a change in the pricing of the card brands VISA and Mastercard.

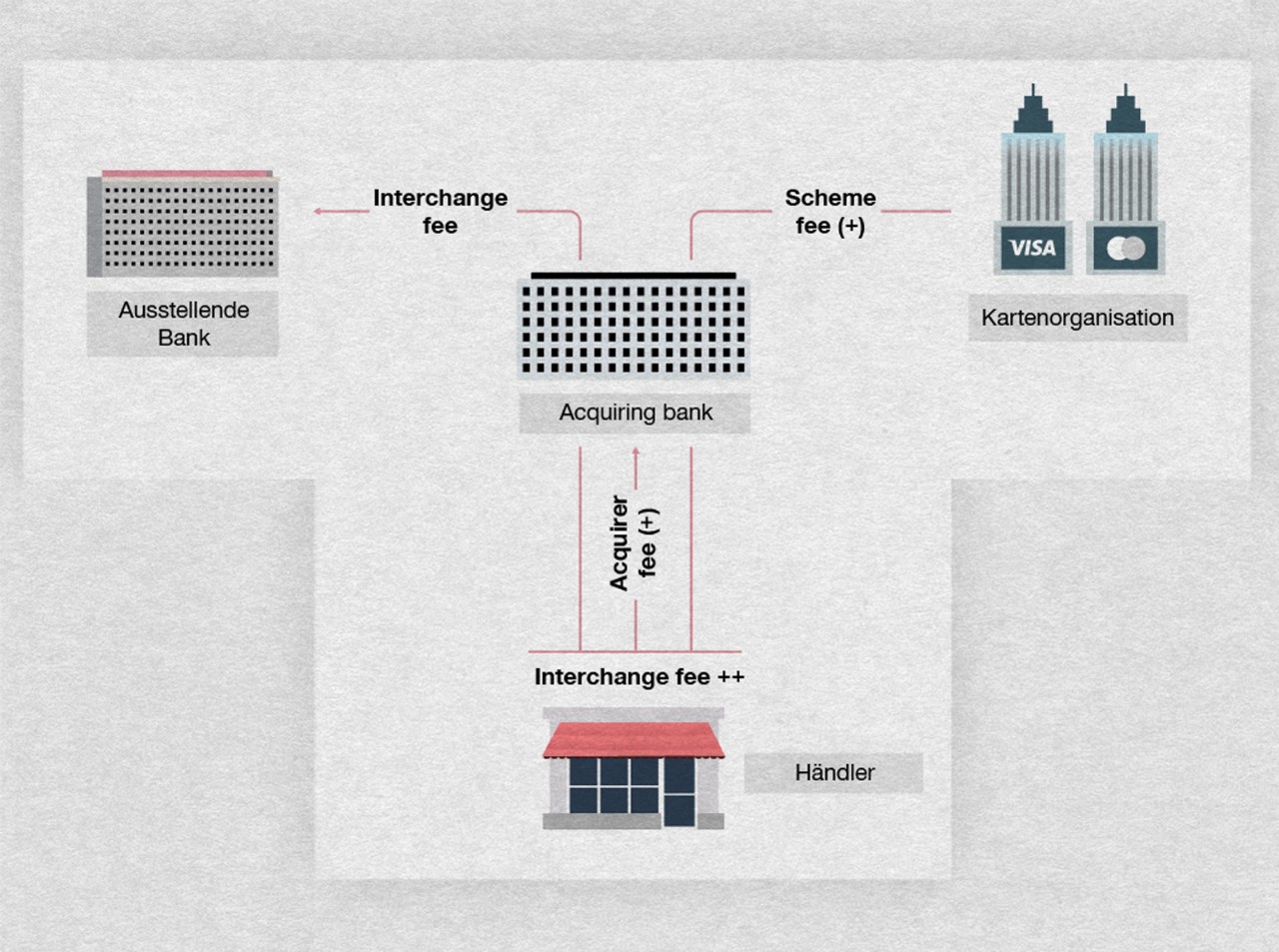

To be able to provide cost transparency, the acquiring banks for VISA and Mastercard credit and debit cards will offer the Interchange++ pricing model. Merchants will also adopt the new Interchange++ model. The new model will be in use for SBB AG and the public transport companies (LTCs) connected to SBB Payment from 1 January 2021 onwards.

New Interchange++ pricing model.

The interchange fee and card scheme fee vary depending on the origin of the card and transaction processing (chip, eCom etc.) so for the fixed commission an average value was calculated from the interchange fee, the card scheme fee and the acquirer service fee. For Interchange++ pricing, all three components mentioned above are variable and are shown per transaction and transferred directly to the merchant. The acquiring service fee is usually negotiated with the acquirer for one year. The interchange fee and the card scheme fee are generally pre-determined and cannot be negotiated. They can change at any time.

In the new pricing model, the commission is made up as follows:

| ICF | Interchange Fee (card issuer fee) |

|---|---|

| + | Card Scheme Fee (card association fee) |

| + | Acquiring Service Fee (acquirer fee) |

Interchange fee (ICF).

This fee is due for every card transaction and is paid by the merchant bank (acquirer) to the customer bank (issuing bank). For this reason, they may also be referred to as interbank fees. The interchange fee depends on the card, card origin, card type and the acceptance of the technology used in the transaction. In particular, international transactions incur higher fees than purely domestic transactions. The fee is shown ad valorem (as a percentage of turnover).

Card scheme fee (+).

For processing the transaction, card associations like Visa or Mastercard levy fees can vary according to location, the technology used in the transaction, the acceptance or the card type. The fee is shown ad valorem (as a percentage of turnover).

Acquirer service fee/acquirer fee (+).

A fixed fee is charged for the provision of the card service (in cents per transaction) which already includes the costs for processing the services.

The benefits to the public transport companies of SBB AG’s payment services will be maintained:

- Pooling in purchasing: higher volumes mean lower prices.

- Guaranteed pricing transparency.

- The prices are passed on 1:1.

Changes for the public transport companies (LTCs) connected to SBB Payment.

Commission calculation.

Every transaction will be categorised by interchange card scheme and the price calculated accordingly. The acquirer fee negotiated by SBB AG will be added to that price. That means that only the acquiring service fee negotiated will now be published.